How to File Business Taxes: A Step-by-Step Guide for Small Businesses

As a leader in your industry, you understand that managing business income tax and overall business tax obligations drives long-term success in India’s evolving economy. Insights from the deAsra dreamBIG podcast, featuring experts Mr. Amit Lomte and Mr. Anoop Tabe, highlight how accurate bookkeeping builds financial strength.

They stress that data serves as a key resource for smart choices, while grasping true profit—beyond just cash balances—helps sidestep pitfalls. deAsra supports and engages small businesses via dreamBIG initiatives, delivering tools and guidance for these essentials. For a clearer grasp on calculations, check this guide on how to calculate your business income tax.

Understanding Business Tax in India

Business tax covers GST and business income tax, designed to aid small enterprises. For proprietorships or partnerships, these ensure balanced contributions with deductions available. GST kicks in if turnover tops ₹40 lakh for goods or ₹20 lakh for services, creating a uniform system nationwide. Business income tax targets profits after expenses, with rates based on turnover and regime.

Leaders see strong business tax handling as boosting trust with banks and investors. Mr. Amit Lomte shared on the dreamBIG podcast: “Books of accounts are a gateway to growth and have a multifold effect on business success.” Proper filing unlocks funding and schemes. Classify income accurately—from operations, investments, or elsewhere—for precise liabilities. Skipping this risks penalties, calling for organised methods.

Digital portals have eased compliance. MSMEs benefit from presumptive taxation under Section 44AD, deeming profits at 8% (non-digital) or 6% (digital) of turnover up to ₹3 crore (with conditions), skipping detailed records.

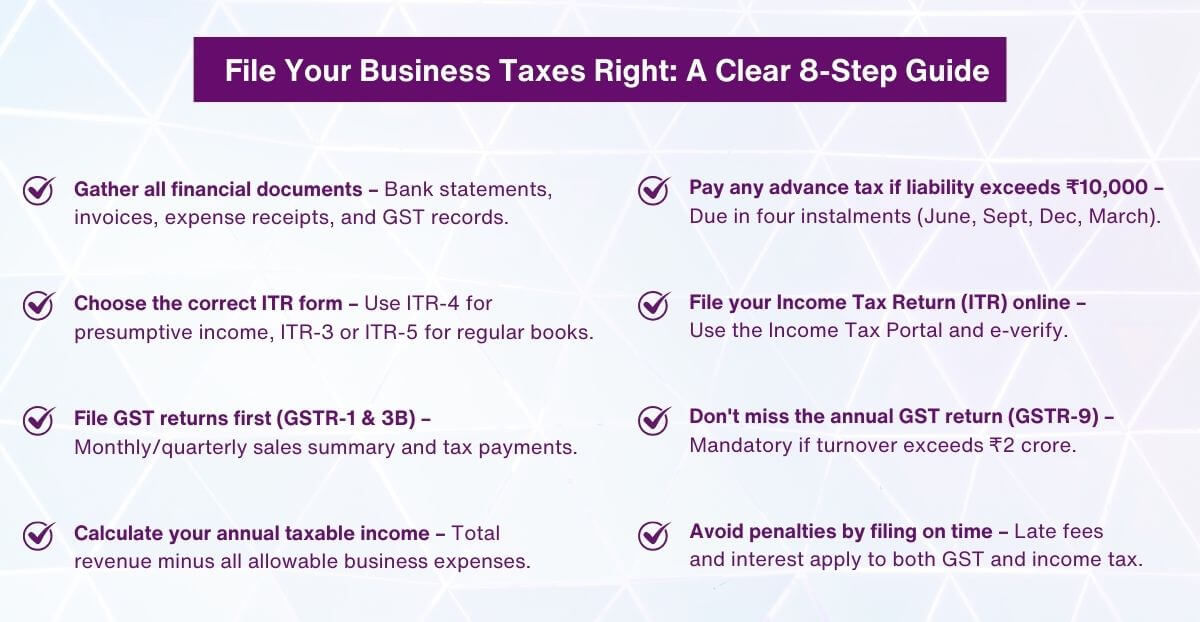

Preparing Documents for Business Tax Filing

Gather key papers upfront for smooth business income tax and business tax steps. Secure PAN and TAN if needed. Prepare financials: profit/loss, balance sheet, cash flow. Include invoices, expense receipts, bank statements, and asset details with depreciation.

For GST, track supplies, input credits, and e-way bills. Reconcile with GSTR-2A/2B. Mr. Anoop Tabe noted: “The accuracy, speed, reliability, and integrity of the data are very important.” This prep avoids delays and matches deAsra’s push for SOPs in data handling.

Monitor advance tax if business income tax exceeds ₹10,000, due 15 June, September, December, and March. Interest applies otherwise. Use software like Tally for automation. deAsra supports and engages with prep checklists.

Quick Guide to GST Return Filing

Log in to gst.gov.in. New registrants: Apply via GST REG-01.

QRMP Scheme: For turnover ≤ ₹5 crore – quarterly GSTR-1 & GSTR-3B; monthly payments via PMT-06.

- GSTR-1 (Outward Supplies):

- Monthly: By the 11th of next month.

- Quarterly (QRMP): By the 13th of the month after the quarter.

- Reconcile ITC: Use GSTR-2A (dynamic) & GSTR-2B (static).

- GSTR-3B (Summary Return):

- Monthly: By the 20th of next month.

- Quarterly (QRMP): By 22nd/24th of the month after the quarter (state-dependent).

- Pay Tax: Before filing GSTR-3B; 18% interest on delays.

- Late Filing:

- Nil return: ₹20/day.

- Others: ₹50/day (capped for small taxpayers).

- Plus 18% interest on unpaid tax.

Annual GSTR-9 (FY 2024-25): Due 31 Dec 2025.

- Optional if turnover ≤ ₹2 crore.

- Mandatory > ₹2 crore; GSTR-9C required > ₹5 crore.

Check the GST portal for extensions/notifications. Timely filing ensures smooth ITC.

Step-by-Step Guide to Filing Business Income Tax Returns

Handle business income tax via incometaxindia.gov.in. For FY 2024-25 (AY 2025-26), the main deadline passed in September 2025; belated possible until 31 December 2025 with fees.

- Log in with PAN.

- Pick ITR: ITR-4 for presumptive (turnover <₹3 crore conditions), ITR-3 otherwise.

- Fill offline utility: income, deductions, computations.

- Validate, upload XML.

- E-verify via OTP or other.

- Pay balance via Challan 280.

Partnerships use ITR-5. deAsra supports and engages via virtual CFOs.

Options for Filing: Online vs. Professional

Choose online for simplicity in business tax, via portals—cost-effective for basics. Tools integrate data.

Professionals shine for complexity. Mr. Anoop Tabe said, “If you feel compliance is costly, try non-compliance.” Experts maximise deductions, ease the burden.

Explore deAsra’s accounting and taxation support.

Common Mistakes to Avoid

Mixing personal/business expenses distorts business income tax. Ignoring depreciation cuts taxable profits wrongly. GST mismatches trigger notices.

Under-reporting risks 300% penalties. Use SOPs as podcast advised. Software and audits help solid business tax.

Benefits of Timely Compliance

Timely business tax filing avoids penalties, improves loan/subsidy access. Banks review returns for credibility. Builds investor confidence, per Mr. Amit Lomte‘s examples.

Promotes discipline for budgeting. deAsra’s dreamBIG turns taxation into a growth tool.

Conclusion

Mastering business tax and business income tax empowers small owners. This guide—from prep to verification—simplifies it. Use digital tools and experts for the best results. As leaders, treat taxation as a foundation strengthener. deAsra supports and engages via dreamBIG, readying you for wins. Act proactively; let filing fuel growth.

FAQs

1. What deadlines apply for business income tax returns in India?

For FY 2024-25 (AY 2025-26), the non-audit deadline was September 2025. Belated filings go to 31 December 2025 with penalties. Planning avoids interest.

2. Which ITR form suits small proprietorships for business income tax?

Use ITR-4 for presumptive under Section 44AD (turnover limits), or ITR-3 for regular accounts. Depends on the method, easing straightforward cases.

3. How does GST link to business tax filing?

GST data influences business income tax profits. GSTR-1 sales and 3B credits affect calculations, ensuring accurate credits and lower outflow.

4. Can small businesses file business taxes without a CA?

Yes, online—but professionals aid deductions/compliance. deAsra’s virtual CFOs offer affordable expert help for complexities.

5. What penalties hit late business tax filings?

GST: ₹20-50/day plus 18% interest. Business income tax: Up to ₹10,000 late fee, plus interest. Timely action preserves standing.