How to Calculate Your Business Income Tax: A Clear Step-by-Step Guide

Empowering Indian Entrepreneurs with Smart Tax Strategies

For Indian business owners, understanding business income tax is vital for financial success and compliance with government regulations. As discussed in the dreamBIG podcast, misjudging profits can lead to costly penalties or missed growth opportunities. CA Anoop Tabe’s insight, “The true test of profitability lies in liquidity,” highlights the need for accurate tax calculations.

This guide simplifies the process of calculating business tax, covering revenue, cost of goods sold (COGS), and deductible expenses. For expert advice, explore deAsra’s accounting and taxation resources.

Why Calculating Business Income Tax Matters

Accurate business income tax calculation is the foundation of a thriving business. It ensures compliance with GST, income tax, and other regulations while revealing your true profit. Mr. Amit Lomte emphasised, “Cash balance does not necessarily reflect your true profit.” Many entrepreneurs mistake their bank balance for profit, ignoring expenses like depreciation or pending payments to suppliers. This can lead to poor financial decisions and inflated business tax liabilities. A systematic approach helps avoid penalties, plan cash flow, and build investor trust.

Step 1: Calculate Your Total Revenue

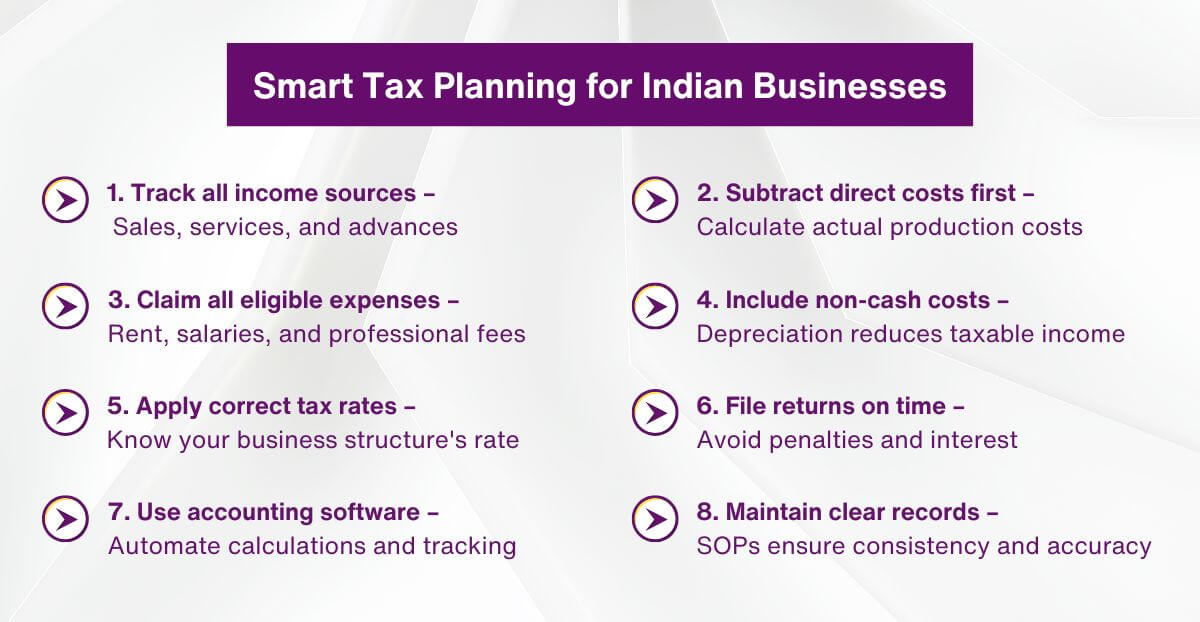

Start by determining your total revenue, which includes all income from sales, services, or other business activities before deductions. For example, a textile shop owner would include income from fabric sales, tailoring services, and advance customer payments. Revenue is not profit—it’s the gross income before expenses.

To calculate revenue:

- Collect records from invoices, bank statements, or payment platforms like UPI.

- Include all business income (cash, digital, or advance payments).

- Exclude personal income, such as savings or personal loans.

Accurate revenue tracking is essential for business tax compliance. Mr. Anoop Tabe suggested using Excel for tracking receivables, but accounting software like Tally can automate this process for efficiency.

Step 2: Determine Cost of Goods Sold (COGS)

Subtract the cost of goods sold (COGS) from revenue to calculate gross profit. COGS includes direct costs like raw materials or labour used to produce goods or services. For a textile shop, this covers fabric purchases and stitching labour costs.

To calculate COGS:

- List direct costs, such as raw materials or production wages.

- Exclude indirect costs like rent or advertising (covered later).

- Track opening stock, purchases, and closing stock using inventory records.

For example, if your revenue is ₹1,00,00,000 and COGS totals ₹40,00,000, your gross profit is ₹60,00,000. Accurate COGS calculation prevents overpaying business income tax on non-taxable costs.

Step 3: Identify Deductible Expenses

Deductible expenses reduce your taxable income, lowering your business tax liability. These include costs incurred to run your business, such as rent, utilities, employee salaries, and marketing. Personal expenses or non-business costs are not deductible.

Common deductible expenses:

- Operational costs: Rent, electricity, office supplies.

- Employee expenses: Salaries, provident fund contributions.

- Professional fees: Chartered accountant or legal services.

- Depreciation: Wear and tear on assets like machinery.

Mr. Amit Lomte noted, “You must take into account non-cash expenses and capital expenditure amortisation.” For instance, depreciation on a sewing machine reduces taxable income without affecting cash flow. Use accounting software to categorise expenses accurately for compliance.

Step 4: Factor in Non-Cash Expenses

Non-cash expenses, like depreciation or amortisation, are critical for business income tax calculations. These don’t involve cash outflows but lower taxable income. For example, if you bought machinery for ₹20,00,000 with a 5-year lifespan, you might claim ₹4,00,000 annually as depreciation.

To account for non-cash expenses:

- Identify assets like equipment or vehicles.

- Apply depreciation rates as per Indian tax laws.

- Record these in your books, even without cash transactions.

This step ensures your business tax reflects true profitability, not just cash in hand, as stressed in the podcast’s discussion on true profit.

Step 5: Calculate Taxable Income

Subtract COGS and deductible expenses from revenue to find taxable income, the amount subject to business income tax.

Verify deductions to minimise your business tax liability. Errors in data entry, as Mr. Anoop Tabe warned, follow the “garbage in, garbage out” principle, leading to unreliable financial reports.

Step 6: Apply the Correct Tax Rate

In India, business income tax rates depend on your business structure. Companies pay Corporate Tax (25% for domestic companies with turnover up to ₹400 crore, 30% for others, as of 2025). Sole proprietors or partnerships pay Income Tax based on slab rates (e.g., 30% for income above ₹15,00,000).

For example, a company with ₹30,00,000 taxable income might pay 25% (₹7,50,000). Sole proprietors with ₹30,00,000 income (after exemptions) pay based on slab rates. Check the latest tax rates, as the podcast noted, evolving tax regimes like the new direct tax code.

Step 7: File Your Tax Return and Pay On Time

File your business tax return with the Income Tax Department or GST portal by the deadline (e.g., 31st July for businesses). Use online portals or accounting software for accurate submissions. Late filings incur penalties and interest, as Mr. Amit Lomte cautioned, impacting profitability.

To ensure timely compliance:

- Maintain a compliance calendar for deadlines like GST or advance tax.

- Use virtual CFO services for automated reminders.

- Pay advance tax in four instalments if the liability exceeds ₹10,000.

Timely filing avoids penalties and boosts credibility with banks and investors, as highlighted in the podcast.

Leveraging Technology for Business Tax Compliance

AI-driven accounting software simplifies business income tax calculations. Tools like Tally integrate with bank APIs to import transactions, categorise expenses, and pull GST data (GSTR-1, GSTR-2A/2B). Optical character recognition (OCR) converts physical bills into digital entries. Mr. Anoop Tabe noted that 95% of accounting is automated, allowing entrepreneurs to focus on review. For more insights, visit deAsra’s blog.

Standard Operating Procedures (SOPs) for Accuracy

SOPs for accounting processes ensure consistency and reduce errors. Establish protocols for recording sales, categorising expenses, and reconciling bank statements. SOPs minimise non-compliance risks, like ledger duplication, and make your business less person-dependent, as both experts emphasised.

Conclusion: Build a Strong Foundation with Business Income Tax Mastery

Calculating business income tax is a critical skill for Indian entrepreneurs. By systematically tracking revenue, COGS, deductible expenses, and non-cash items, you ensure compliance with GST and income tax laws while gaining clarity on profitability. AI tools, SOPs, and virtual CFO services streamline the process, saving time and reducing errors. For industry leaders, mastering business tax drives financial discipline, investor confidence, and sustainable growth. Take control today by implementing robust accounting systems and staying proactive with compliance.

FAQs

1. Why is accurate bookkeeping essential for business income tax?

Accurate bookkeeping ensures business tax calculations reflect true revenue and expenses, preventing penalties or overpayment. It supports GST and income tax compliance, provides a clear financial picture, and builds trust with investors, as discussed in the dreamBIG podcast.

2. What expenses can I deduct to reduce my business tax?

Deductible expenses include rent, utilities, salaries, professional fees, and depreciation. Personal or non-business expenses are not allowed. Verify with Indian tax laws to maximise deductions while ensuring compliance, as per the podcast’s advice.

3. How does AI help with business income tax calculations?

AI automates 95% of accounting tasks, such as importing bank transactions, categorising expenses, and pulling GST data. OCR converts physical bills into entries, saving time and ensuring accuracy, as Mr. Anoop Tabe highlighted in the podcast.

4. How often should I review my business tax calculations?

Startups should review monthly to track revenue and costs. Established businesses can review quarterly unless GST or tax law changes require immediate checks. Regular reviews identify variances, aligning with the podcast’s budgeting insights.

5. What happens if I miss business tax filing deadlines?

Late filings lead to penalties and interest, reducing profitability. Non-compliance may trigger audits, resulting in wasted time and resources. A compliance calendar or virtual CFO services, as suggested by Mr Amit Lomte, ensures timely submissions.