What GST 2.0 Means for Nano Enterprises in India

The Government of India has introduced the next set of reforms in Goods and Services Tax (GST), known as GST 2.0. GST 2.0 mainly focuses on the reduction and simplification of tax rates, along with a few other changes. The economic intuition behind these reforms is simple: fewer taxes mean firms can charge lower prices without affecting their profits. Lower prices mean more demand, which bodes well for businesses.

The rate cut is sweeping, and hence we expect the high tide of greater demand to lift all boats—bigger firms, medium enterprises, as well as nano enterprises, which make up the bulk of enterprises in the economy. For easy reference, nano enterprises are businesses with an annual turnover of up to ₹1 crore. And though statisticians and empirical economists may have their qualms around accurate estimates, at least 80% of enterprises in India fall into the nano category, which is part of ‘micro’ enterprises as per the official definition.

GST 2.0 will have positive repercussions for nano enterprises through various channels. First, buoyancy in demand will help these enterprises sell more, earn higher profits, and invest further, kick-starting a virtuous cycle of growth. Second, the reduction in rate slabs and pre-filled GST returns will reduce compliance costs—an Achilles’ heel of these enterprises in dealing with GST. Pre-filled returns are likely to reduce the resources spent on entering required information and the errors arising from it. A subset of nano enterprises—those engaged in exports—will have additional benefits through automated refund mechanisms. Automated refunds, which are likely to be quicker than the current system, will ease working capital requirements. The simplified registration process will increase the tax base by reducing barriers to GST registration. Improvements in dispute resolution can speed up settlements and reduce the loss of capital and time that firms face. The increasing role of AI and data analytics has also been envisioned to incentivise regular taxpayers while improving the detection of fraud and non-compliance.

A large fraction of nano enterprises have turnovers below the mandatory limits of GST registration: ₹20 lakhs for services and ₹40 lakhs for goods. Yet GST is increasingly becoming a necessary condition for market access due to business-to-business (B2B) transactions. As per a SIDBI report, nearly 70% of businesses engage in B2B transactions. Buyers of nano enterprises, when they are themselves businesses, prefer GST-registered suppliers to claim input tax credits on supplies. Nano enterprises also need GST to use e-commerce platforms for selling their products. Additionally, banks and financial institutions increasingly treat GST as a mark of creditworthiness and actively use applicants’ GST information for assessment. In other words, irrespective of mandatory thresholds, GST is a must for any serious business.

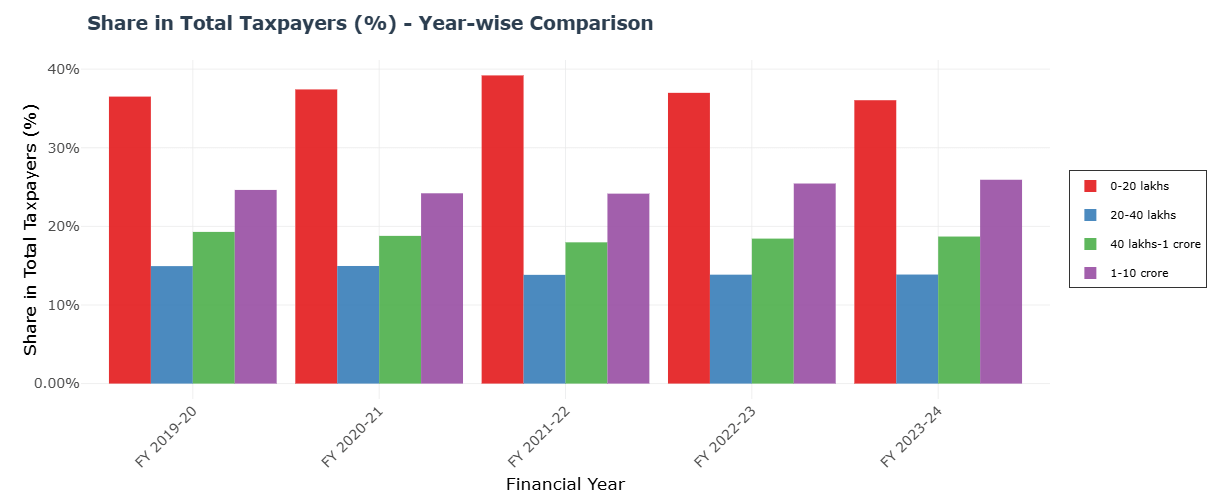

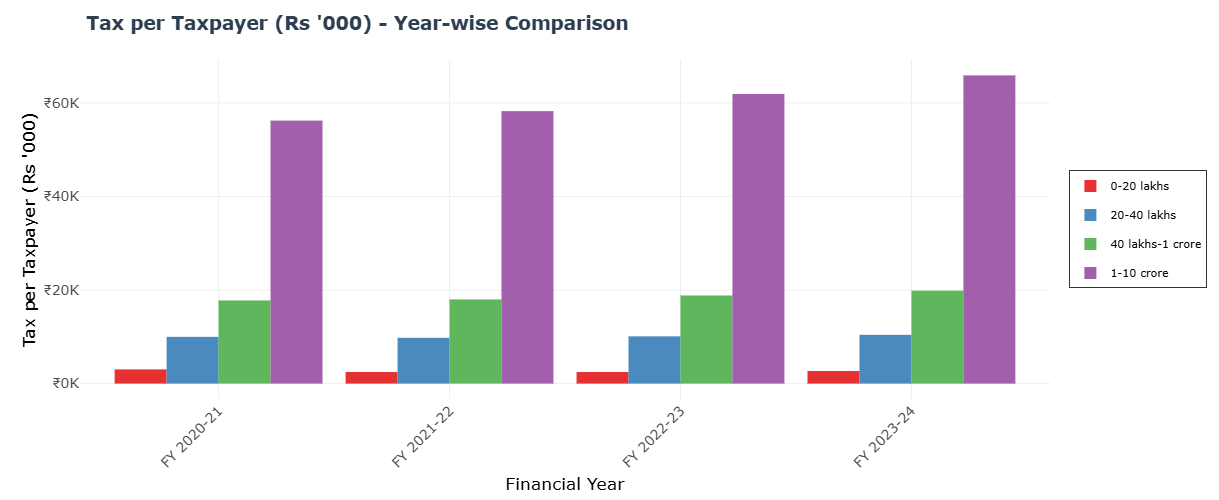

It is no surprise that nano enterprises form a large share of GST-registered taxpayers. Nearly two-thirds of GST-registered taxpayers who file non-NIL returns are businesses with turnovers up to ₹1 crore. (Figure 1) But tax per taxpayer from nano enterprises is about ₹3,000, ₹10,000, and ₹18,000, for turnover slabs of ₹0–20 lakhs, ₹20–40 lakhs, and ₹40 lakhs–₹1 crore respectively. (Figure 2)

Figure 1 (Source: GST annual reports)

Figure 2 (Source: GST annual reports)

The compliance burden—the costs these businesses must incur to pay GST—is considerable, especially when compared to the tax they pay and their turnovers. Unfortunately, there is no systematic estimate of compliance costs available, though compliance burden has long been flagged as a nagging issue, particularly for smaller enterprises. A study by the Madras School of Economics, conducted in 2019 and based on a survey of GST-registered enterprises in Erode division of Tamil Nadu, estimated that enterprises with turnovers up to ₹1.5 crore spent about 350 hours annually on compliance. In monetary terms, GST compliance was costing on average ₹12,000 in external resources and ₹29,000 when internal (staff and management) and external resources were combined. The ratio of compliance cost to revenue was about 1% to 1.5% for enterprises with turnover up to ₹40 lakhs. This compliance cost burden eats into already thin profit margins.

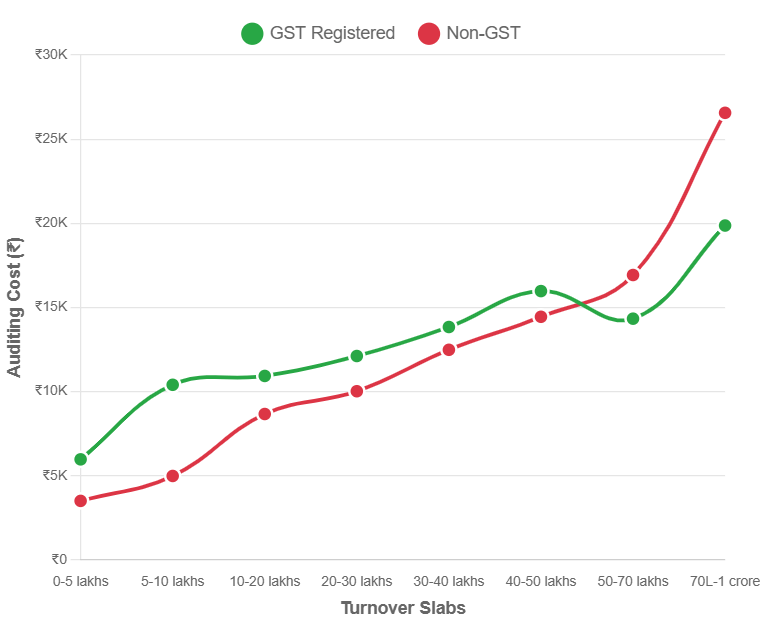

The Annual Survey of Unincorporated Sector Enterprises (ASUSE) 2023-24 provides another way of looking at costs associated with GST. GST-registered enterprises below the mandatory GST thresholds of ₹20 lakhs (services) and ₹40 lakhs (goods) have to account for higher costs associated with activities like auditing and bookkeeping compared to their non-GST registered peers. It also shows an interesting trend of higher costs for non-GST enterprises once the threshold turnover limit is crossed.

Figure 3 (Source: Calculations based on ASUSE 2023-24)

Smaller businesses have long highlighted compliance burden and registration difficulties, along with other bureaucratic hurdles. The GST Council has taken cognizance of these concerns. GST 2.0 is a welcome step to ease the integration of smaller businesses into the GST system. The details of how GST 2.0 reforms reduce compliance burden will emerge in due time. GST authorities must also ensure that systematic evidence is provided, which can improve perception and attitudes toward GST. GST 2.0 is not the end of reforms that nano enterprises need. The frequent filing requirements and costs of invoice preparation due to informational needs are among the issues that still need to be addressed in the future.

The Navratri and Diwali season has begun with the festive cheer of GST 2.0. We expect that the future will entail a further set of reforms—enabled by technology and data—that continue this festival of growth for nano enterprises.

GST Insights Dashboard – A Closer Look

The GST Insights Dashboard by deAsra Foundation is an interactive platform designed to make GST-related data accessible and easy to understand. It presents key information on taxpayer distribution, turnover categories, tax contributions, compliance patterns, and other indicators derived from official GST data—all in a visually friendly format.

Objectives:

-

To serve as a knowledge resource that complements policy research and on-ground interventions.

-

To highlight trends such as the share of nano enterprises in the GST system, tax contributions by turnover category, and compliance behaviour.

Benefits:

-

Offers a quick, data-driven snapshot of how small businesses engage with GST.

-

Helps users identify where compliance burdens are highest and how reforms like GST 2.0 might impact nano enterprises.

How to Read the Data:

Figures and charts illustrate the distribution of GST-registered taxpayers by turnover slab, average tax paid, and compliance costs—giving a clear view of the nano segment’s participation. These visuals can be used to track GST attributes over time and to identify opportunities for policy support and enterprise growth.

See the interactive GST Insights Dashboard to explore the data and visualizations behind this article.

Note: Figure 1 (Source: GST annual reports) and Figure 2 (Source: GST annual reports) are taken from the GST dashboard prepared by deAsra Foundation. This dashboard is an attempt to provide GST-related information in an accessible manner to end users, including academicians, journalists, policy researchers, and curious individuals. You can access the dashboard at https://www.deasra.in/insights-dashboard/.

Author: Dr. Kiran Limaye

Senior Research Fellow at deAsra Foundation.