Start Your Business Online: A Beginner’s Guide to E-Commerce and Digital Services

Are you ready to turn your skills or ideas into a thriving online venture in 2026? India’s digital economy continues to surge, with e-commerce projected to hit massive growth and digital services in high demand—from freelance consulting to virtual coaching. Many professionals and beginners launch their careers successfully, but overlooking self-employment tax early can derail their progress.

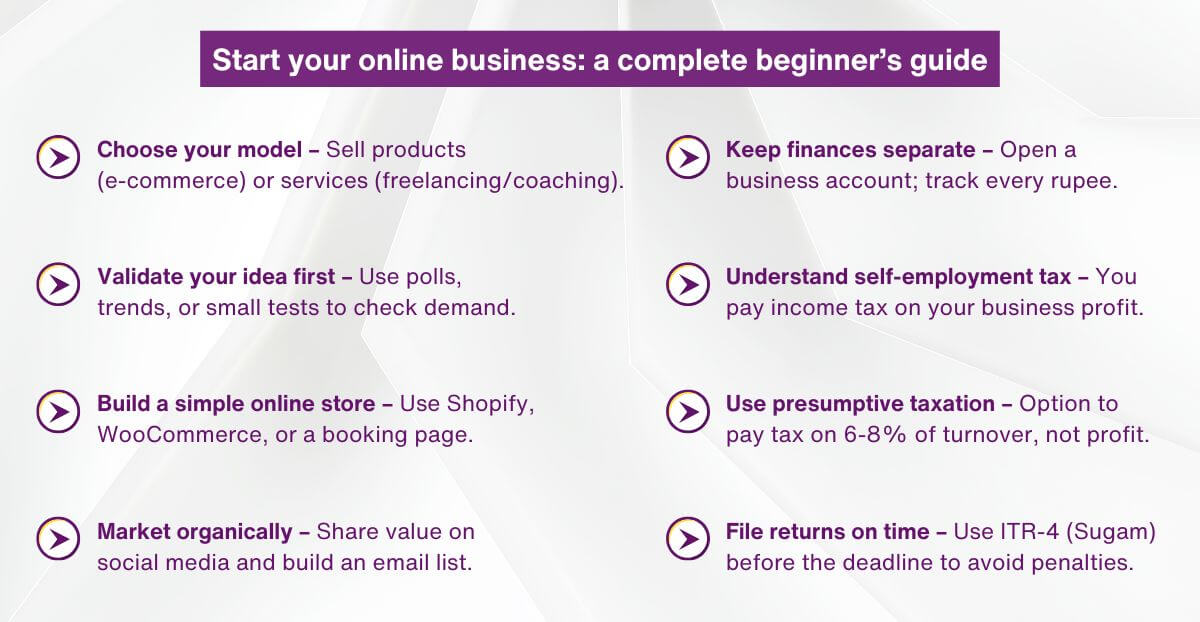

In the deAsra and dreamBIG podcast, Mr. Vikrant Bhujbalrao stresses validating ideas and building strong foundations, including smart financial planning. This straightforward guide covers essentials for starting in e-commerce or digital services, plus a clear breakdown of self-employment tax for freelancers, sole proprietors, and independent contractors. Dive into deAsra’s resources on accounting and taxation for practical tools.

Why Launch Online in 2026?

India’s online market thrives on rising smartphone use, affordable data, and shifting buyer habits. E-commerce platforms handle logistics, while digital services need almost zero overhead—just expertise and a good connection.

Pick a model that fits you. E-commerce sells products (physical via dropshipping or digital, like e-books/templates). Digital services deliver value through skills (graphic design, content writing, online tutoring, virtual assistance, or AI-powered consulting). Trends show strong demand for sustainable goods, health/wellness items, smart gadgets, and eco-friendly accessories in e-commerce; for services, digital marketing, SEO, social media management, and no-code app building lead.

Validate quickly: use Google Trends, check competitors, run small tests or polls. Focus on real needs to avoid common pitfalls.

Build Your Online Setup Quickly

Secure a domain and choose a platform—Shopify or WooCommerce for e-commerce, simple sites or tools like Calendly for services. Integrate Indian payments (Razorpay, PayU) and shipping (Delhivery, Shiprocket) where needed. Ensure a mobile-friendly design since most traffic comes from phones.

Keep it simple at first: register as a sole proprietorship for minimal hassle. Register for GST once turnover crosses ₹20 lakh (services) or ₹40 lakh (goods)—or voluntarily for credibility and tax credits. Add clear terms, privacy policies, and fast support to build trust.

Attract Customers on a Budget

Start organic: share valuable content on Instagram, LinkedIn, YouTube, or WhatsApp. Post tips, demos, or stories to draw interest. Build an email list for direct follow-ups.

Use your network—offer introductory rates or samples for reviews. Track key metrics: traffic, conversions, repeat buyers. Once proven, scale with targeted ads on Meta or Google. Consistency beats big spends early on.

Operate Efficiently and Prepare to Grow

Set basic systems day one: track income/expenses (Google Sheets to start, then Zoho or Vyapar). Automate invoices, reminders, and customer queries.

Stay solo for the first six months to keep control, then bring in freelancers or a co-founder for bandwidth. Prioritise health—exercise and mindfulness—to manage stress and sustain momentum. Review finances monthly; cash flow reveals true health.

What Self-Employment Tax Really Means

A clear explanation of this critical tax for freelancers, sole proprietors, and independent contractors keeps your online business compliant and profitable. India has no distinct “self-employment tax”—it falls under income tax on business/profession profits (heading “Profits and Gains from Business or Profession”).

Compute taxable profit: gross receipts minus allowable expenses (marketing, internet, tools, home office portion). Presumptive taxation (Section 44AD) simplifies for many: deem 6% profit on digital receipts or 8% overall (turnover up to ₹3 crore), no need for full books if eligible.

Self-employment tax kicks in via income tax slabs (new regime default, lower rates but limited deductions). Pay advance tax quarterly if the liability exceeds ₹10,000 yearly. File ITR-4 (presumptive) or ITR-3 annually, usually by July/September. GST applies separately to turnover thresholds.

Self-employed income tax uses the same slabs—claim deductions wisely to lower it. Maintain separate business accounts to avoid mixing expenses, which raises self-employment tax liability.

deAsra supports and engages entrepreneurs with guidance—check their detailed post on how to file business taxes.

Avoid errors: ignore advance tax (interest accrues), skip records (penalties follow), or miss deductions (higher self-employed income tax). Use AI tools like Zoho Books or Vyapar for easier tracking. Self-employment tax planning turns obligation into opportunity—deduct travel, software, and depreciation.

Scale Sustainably

With steady sales, expand offerings, target new audiences, or hire help. Reinvest profits thoughtfully. Foster good relationships for long-term success. Balance work and life—true achievement includes freedom and contribution.

Conclusion

Starting online in e-commerce or digital services offers real potential in India’s growing market. Validate your idea, launch simply, prioritise customers, establish systems, and address self-employment tax and self-employed income tax upfront for smooth growth. Leverage deAsra and dreamBIG insights to move forward confidently. Take action today—research one trend or test one idea. Progress comes from starting.

FAQs

1. Which online model suits beginners better—e-commerce or digital services?

E-commerce fits if you prefer products (dropshipping keeps costs low), while digital services suit skill-based work (no stock needed). Both launch affordably; choose based on your expertise and test demand fast.

2. How should new online entrepreneurs handle self-employment tax?

Self-employment tax means income tax on business profits for freelancers and sole proprietors. Opt for presumptive taxation if eligible, pay advance tax quarterly when due, file ITR yearly, and track expenses for deductions to minimise self-employed income tax.

3. When is GST registration required for an online business?

GST applies above ₹20 lakh turnover for services or ₹40 lakh for goods. Register voluntarily earlier for input credits and professional appeal to clients.

4. What common errors increase self-employed income tax for online starters?

Mixing personal and business expenses, overlooking deductions, or delaying advance payments inflate self-employed income tax and risk penalties. Use separate accounts and consistent tracking to stay low.

5. In what ways does deAsra support online entrepreneurs?

deAsra supports and engages through mentoring, checklists, AI tool recommendations, and expert sessions on taxation, compliance, and scaling—including handling self-employment tax for sustainable online growth.