Business Tax 101: A Beginner’s Guide for New Entrepreneurs

“GST is important in several ways. Banks offer funding schemes, such as working capital limits, based on your GST filings,” says Mr. Amit Lomte, a chartered accountant with over a decade of expertise.

New entrepreneurs often find business tax daunting, yet it’s a cornerstone of sustainable growth. As highlighted in the dreamBIG podcast by deAsra Foundation, experts Mr. Amit Lomte and Mr. Anoop Tabe unpack the essentials of accounting and taxation, offering insights for industry leaders across tech, retail, and manufacturing. This guide simplifies business tax for beginners, explaining its types and importance while weaving in practical tips from the podcast. For more resources, explore the dreamBIG initiative on accounting and taxation. With smart business tax planning, you can turn compliance into a strategic advantage.

What Is Business Tax?

Business tax refers to the financial obligations a company owes to the government based on its earnings, sales, and operations. It’s not just a deduction from profits but a reflection of how well a business manages its finances to meet legal requirements. For new entrepreneurs, understanding business tax early prevents penalties and supports growth.

It funds public services while regulating economic activities, varying by region. In India, for instance, it includes income tax on profits and goods and services tax (GST) on transactions. Proper business tax planning ensures compliance while freeing up resources for innovation.

Types of Business Tax

1. Income Tax

Income tax applies to a business’s profits after deducting allowable expenses like salaries, rent, or supplies. Mr. Amit Lomte emphasises in the dreamBIG podcast that true profit isn’t just cash in the bank but accounts for non-cash items like depreciation. For small businesses, simplified regimes like presumptive taxation—where tax is a percentage of turnover—ease the burden. Effective business tax planning involves projecting income to pay advance taxes quarterly, avoiding interest charges. This tax is crucial as it directly impacts your bottom line.

2. Self-Employment Tax

For sole proprietors or freelancers, self-employment tax covers contributions to social security or similar schemes, often a percentage of net earnings. Mr. Anoop Tabe notes the importance of factoring in notional costs, like opportunity costs on retained capital, when computing profits for business tax. This ensures future benefits like pensions but demands meticulous record-keeping. Beginners should use a dedicated business account to separate personal finances, simplifying business tax planning and compliance.

3. Sales Tax (GST)

Sales tax, such as GST in India, is an indirect tax collected from customers and remitted to the government, minus credits for taxes paid on purchases. Registration becomes mandatory once turnover crosses thresholds, like ₹40 lakh for goods in India. Mr. Amit Lomte states, “Timely compliance also benefits vendor registration. Many companies check your GST compliance calendar during the vendor registration process.” Mismatches in input and output taxes can erode cash flow, making business tax planning critical for pricing and competitiveness.

Why Business Tax Matters

Business tax is more than a legal obligation; it shapes your business’s credibility and growth. Compliance ensures access to loans, as banks scrutinise tax filings for creditworthiness. The podcast highlights that non-compliance incurs penalties, with Mr Anoop Tabe noting the saying: if compliance seems costly, try the alternative.

For industry leaders, mastering business tax builds trust with investors and suppliers. It also enables better cash flow management, allowing investment in innovation. For example, timely GST filings can secure better loan terms or vendor partnerships, as discussed in the podcast.

The Role of Business Tax Planning

Business tax planning transforms taxes from a burden into a strategic tool. It involves minimising liabilities legally while maximising deductions. Choosing the right business structure—sole proprietorship, partnership, or company—affects tax rates. Companies face lower corporate taxes but more regulations. Mr Anoop Tabe advises establishing standard operating procedures (SOPs) to reduce risks. AI tools, as discussed in the podcast, automate data pulls from banks and GST portals, ensuring accuracy. Consulting professionals early for business tax planning helps claim deductions on expenses like marketing or equipment.

1. Income Tax Planning

Projecting income and understanding tax slabs are key. Progressive rates mean higher profits face higher taxes, but deductions for investments or donations can lower the burden. The podcast warns against confusing book profit with cash profit, which skews calculations. Quarterly advance tax payments prevent year-end surprises.

2. Self-Employment Tax Planning

Set aside funds regularly, perhaps quarterly, to cover self-employment tax. A separate business account simplifies tracking, ensuring compliance without stress.

3. Sales Tax Planning

Timely invoicing and reconciliation are vital. Use software to track input tax credits, avoiding cash flow issues. Regular GST filings enhance vendor credibility and funding access.

Real-World Impact of Business Tax

The podcast shares compelling examples. A small shop neglecting GST filings risks registration cancellation, halting operations. Conversely, a compliant entrepreneur secures better loan terms due to consistent business tax payments. Mr. Amit Lomte recounts a 1.5-year-old company acquired by a U.S. firm because its records were impeccable, proving business tax readiness attracts opportunities. In sectors like manufacturing, where inventory ties up capital, business tax planning preserves liquidity, enabling reinvestment.

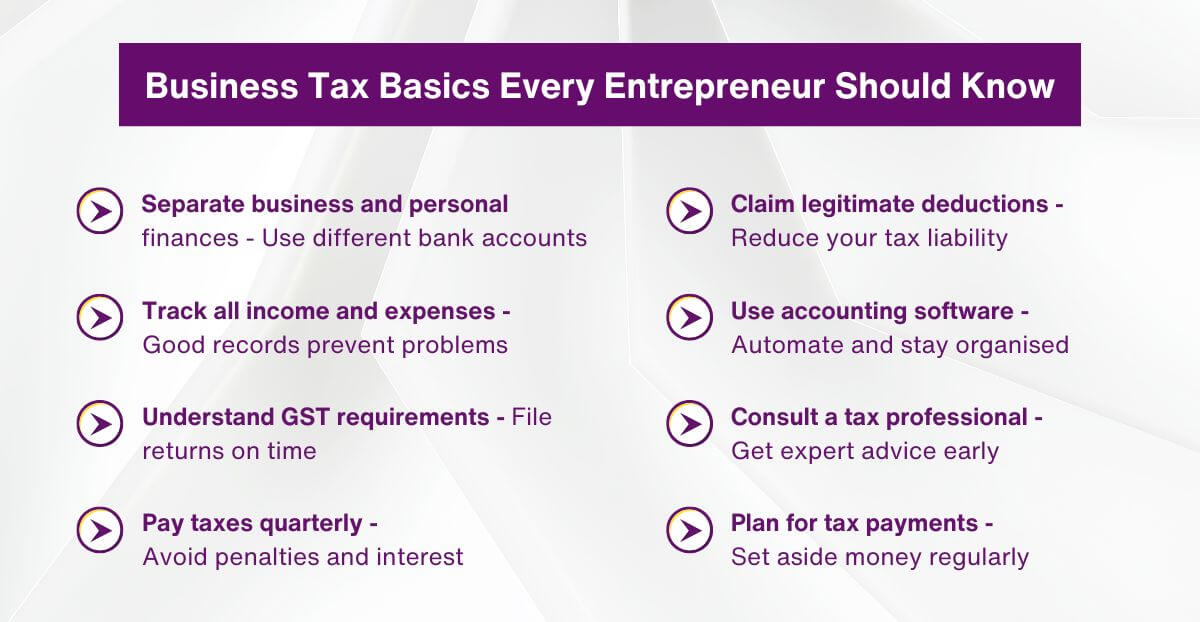

Practical Steps for Beginners

1. Robust Bookkeeping

Bookkeeping is the foundation of business tax. Use cloud-based software for multi-location businesses to ensure real-time access. The podcast recommends starting bookkeeping from the day you discuss your business idea, as Mr Anoop Tabe suggests, “The day you discuss your business idea over coffee.”

2. Virtual CFO Services

For small teams, virtual CFOs provide expert oversight at minimal cost. They manage compliance calendars, ensuring timely filings for business taxes. This hybrid model combines in-house tracking with professional expertise, as highlighted by the podcast.

3. Avoid Common Mistakes

Mixing personal and business expenses leads to disallowed deductions. Delaying entries causes inaccurate reports. Mr Anoop Tabe’s “garbage in, garbage out” principle underscores choosing scalable software that integrates with government portals for seamless business tax compliance.

Leveraging Government Initiatives

In India, doubled MSME thresholds expand eligibility for subsidies, rewarding business tax compliance. Simplified tax regimes reduce paperwork, freeing focus for core activities. The podcast notes how these changes increase disposable income, boosting GST collections through consumption. For global leaders, similar incentives like R&D tax credits apply in tech sectors. Stay updated via resources like the deAsra blog.

Budgeting for Business Tax

Budgeting informs business tax planning by estimating liabilities. Mr Anoop Tabe advises pessimistic revenue forecasts and optimistic cost assumptions to build buffers. Track variances monthly for non-seasonal startups or quarterly for seasonal businesses. This discipline ensures funds for tax payments, avoiding penalties that could reach 300% of evaded amounts.

Financial Discipline Tips

- Separate Accounts: Use a current account for business transactions and a savings account for personal expenses to clearly distinguish between business and personal profits.

- Avoid Impulsive Buying: Evaluate purchases for value, avoiding luxuries unless they drive growth.

- Outsource Non-Core Tasks: Focus on core competencies, as Apple does by outsourcing manufacturing, as discussed in the podcast.

Conclusion

Business tax is a critical pillar for new entrepreneurs, encompassing income, self-employment, and sales taxes. Through strategic business tax planning, compliance becomes a growth driver, unlocking funding and partnerships. The dreamBIG podcast underscores that accounting starts with your business idea, not operations. Leverage AI tools, virtual CFOs, and SOPs to streamline processes. By mastering these basics, you’ll build a resilient venture ready for success across industries.

FAQs

1. What is business tax, and why is it important for startups?

Business tax includes taxes on a company’s profits, sales, and operations, such as income tax and GST. It’s crucial for startups because compliance ensures legal operations, builds credibility with banks and investors, and avoids penalties. Proper business tax planning helps manage cash flow and supports growth by unlocking funding opportunities.

2. How does GST affect small businesses?

Goods and Services Tax (GST) is a sales tax collected from customers and remitted to the government. For small businesses, timely GST filings are vital for vendor registration and securing loans, as highlighted by Mr. Amit Lomte in the podcast. Effective business tax planning ensures accurate invoicing and input tax credits, maintaining competitiveness and cash flow.

3. Should I handle business tax in-house or outsource it?

A hybrid approach works best for startups. In-house bookkeeping tracks daily operations, while outsourcing to experts like virtual CFOs ensures compliance with complex business tax regulations. As Mr. Anoop Tabe notes, outsourcing leverages expertise, saving time and reducing errors in business tax planning.

4. How can AI tools simplify business tax for beginners?

AI tools automate 95% of accounting tasks, such as importing bank statements or GST data, as discussed in the podcast. They categorise transactions and use OCR to convert bills into entries, streamlining business tax planning. This reduces manual work, ensuring accuracy and freeing entrepreneurs to focus on growth.

5. What’s the biggest mistake to avoid in business tax planning?

Mixing personal and business finances is a common error, leading to disallowed deductions and inaccurate business tax filings. The podcast emphasises using separate accounts and SOPs to maintain clarity. This discipline in business tax planning prevents penalties and supports reliable financial reporting.