Union Budget 2026 Decoded for Nano & Small Businesses!

The Union Budget 2026, presented amid India’s ongoing economic recovery and global ambitions, places strong emphasis on strengthening the Micro, Small, and Medium Enterprises (MSME) sector. Often regarded as the backbone of the Indian economy, MSMEs make substantial contributions to GDP, exports, and large-scale employment generation.

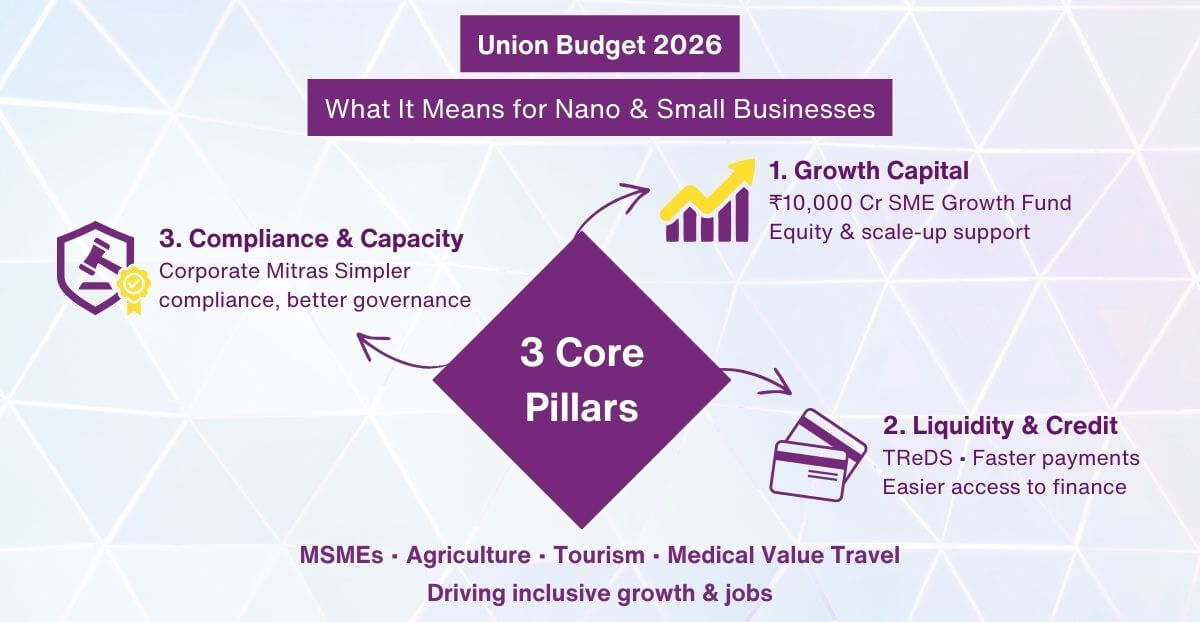

This year’s budget highlights introduce a well-structured three-pronged framework focused on improving capital access, enhancing liquidity, and strengthening capacity building. In addition to core MSME measures, the Union Budget 2026 extends targeted assistance to agriculture-linked enterprises, tourism, and medical value travel — areas positioned to drive inclusive growth, job creation, and improved global competitiveness.

While many business owners closely watched the Union Budget 2026 for updates to personal income-tax provisions, no changes were announced to income-tax slabs under either the new or old tax regime. Instead, the focus remains on structural support for nano and small enterprises. Below, we cover the key budget highlights from the Union Budget 2026.

I. The Three-Pronged Framework for MSME Promotion

The Union Budget builds its MSME strategy around three interconnected pillars that directly tackle the most persistent challenges faced by small businesses.

1. Equity & Growth Capital

A major announcement in the Union Budget 2026 is the creation of a dedicated ₹10,000 crore SME Growth Fund. This corpus is designed specifically to provide equity and quasi-equity financing to high-potential MSMEs, enabling them to scale operations and transition into larger, globally competitive enterprises. Unlike conventional debt financing — which frequently restricts innovation due to fixed repayment obligations — this fund offers more patient capital. Selection of beneficiary enterprises will follow defined criteria covering performance track record, scalability prospects, and quality of governance. The approach actively promotes formalisation and adoption of professional management practices.

Complementing the SME Growth Fund is a ₹2,000 crore top-up to the existing Self-Reliant India Fund (SRI Fund). This additional allocation ensures the continued availability of risk capital, particularly for MSMEs in early-growth and expansion stages, reinforcing long-term capital formation in the sector.

2. Liquidity & Credit Access

Persistent liquidity constraints continue to hamper many small businesses. The Union Budget 2026 addresses this through comprehensive reforms to the Trade Receivables Discounting System (TReDS):

- Mandatory participation of Central Public Sector Enterprises (CPSEs) in TReDS for all purchases from MSMEs

- Integration of TReDS with the Government e-Marketplace (GeM) platform

- Extension of credit guarantee cover from CGTMSE to invoice discounting transactions

- Permission to issue TReDS receivables as asset-backed securities, thereby deepening the secondary market

These combined measures are expected to significantly shorten payment cycles, reduce the effective cost of working capital, and allow small suppliers to redirect cash toward business growth rather than chasing delayed receivables.

3. Compliance Ease & Capacity Building

Compliance burden remains a major hurdle for nano and small entrepreneurs, especially in Tier-II and Tier-III locations. The Union Budget 2026 introduces the Corporate Mitras initiative to ease this pain point.

A cadre of trained para-professionals will be deployed in smaller towns to provide affordable support for statutory compliance, financial reporting, regulatory filings, and basic governance requirements. Professional bodies — ICAI, ICSI, and ICMAI — will develop and deliver short, practice-oriented training programmes for these Mitras. The initiative is expected to lower compliance costs, accelerate filings, and foster a stronger culture of formalisation among micro and small enterprises.

II. Revival of Industrial Clusters

The Union Budget recognises the strategic importance of industrial clusters and announces revival support for approximately 200 legacy clusters nationwide. Many of these clusters suffer from credit stress, technological obsolescence, and infrastructure deficiencies. Targeted interventions will include:

- Upgradation of physical infrastructure

- Modernisation of production technology

- Establishment of shared common facility centres

Particular focus will be given to clusters with strong export or strategic supply-chain potential (container manufacturing, textiles, engineering goods, etc.). Successful implementation in industrial regions of Tamil Nadu, Gujarat, Maharashtra, and others can restore lost productivity, generate fresh employment, and revive export capabilities.

III. Continued Policy Focus on Scaling & Global Competitiveness

The Union Budget aligns MSME interventions with national priorities of manufacturing expansion, export growth, and supply-chain resilience. It builds upon previous policy steps such as:

- Raised investment and turnover thresholds for MSME classification

- Expanded coverage under credit guarantee schemes

- Dedicated support programmes for women entrepreneurs, SC/ST entrepreneurs, and first-generation business owners

These elements collectively position MSMEs as central drivers of employment, innovation, and inclusive economic progress.

IV. Sectoral Highlights

The Union Budget 2026 extends benefits to allied sectors that support millions of small entrepreneurs:

- Dairy & Animal Husbandry Credit-linked subsidy programme + promotion of Livestock Farmer Producer Organisations (FPOs) to modernise units and strengthen value chains.

- Fisheries Development: Development of 500 reservoirs and Amrit Sarovars + value-chain linkages through startups and women-led groups.

- Coconut Promotion Scheme: Replacement of old/non-productive trees with high-yielding varieties in major coconut-growing states.

- Cashew, Cocoa & High-Value Crops Dedicated programme for self-reliance in raw material supply, enhanced domestic processing, and premium global branding by 2030.

- Tourism & Medical Value Travel Pilot training of 10,000 tourist guides + National Destination Digital Knowledge Grid + establishment of five regional medical tourism hubs in public-private partnership mode.

While core incentives for high-value crops (such as the Coconut Promotion Scheme and dedicated programmes for cashew, cocoa, and sandalwood) and allied sectors like dairy, livestock, and fisheries are clearly outlined, certain implementation specifics (e.g., exact FPO scaling or reservoir targets) may receive further details in subsequent guidelines.

Conclusion

The Union Budget 2026 presents a structured set of measures for MSMEs and related sectors. It combines provisions for growth capital, liquidity enhancements, compliance support, revival of legacy industrial clusters, and targeted interventions in specific areas such as high-value agriculture and tourism. By incorporating these elements, the Union Budget addresses key operational and structural challenges faced by MSMEs and allied sectors while preserving continuity in the Union Budget Income Tax Slab arrangements, with no changes announced to personal income tax slabs.

For more practical insights on entrepreneurship, digital marketing, legal compliance, and growth strategies tailored for Indian MSMEs and startups, visit the deAsra Foundation’s Blog here. For entrepreneurs and small business owners seeking professional guidance on accounting, taxation, and compliance needs in light of the Union Budget 2026 announcements, explore tailored accounting and taxation services here.

FAQs

1. What is the SME Growth Fund announced in the Union Budget?

A ₹10,000 crore equity and quasi-equity fund to help high-potential MSMEs scale into larger competitive businesses.

2. How do the TReDS reforms in the Union Budget benefit small suppliers?

Mandatory CPSE usage, GeM integration, CGTMSE guarantees, and securitisation options → faster payments and lower working-capital costs.

3. What exactly are Corporate Mitras, and who can use them?

Affordable trained professionals deployed in Tier-II/III towns to handle compliances, filings, and governance for micro and small businesses.

4. What kind of support is provided for fisheries or dairy under the Union Budget?

Credit-linked subsidies, infrastructure development (reservoirs, dairy facilities), and FPO formation to boost productivity and market access.

5. What is the purpose of the five medical tourism hubs?

To integrate hospitals, diagnostics, wellness, and post-care services in partnership with private players, positioning India as a global medical value travel destination and creating opportunities for service-based MSMEs.