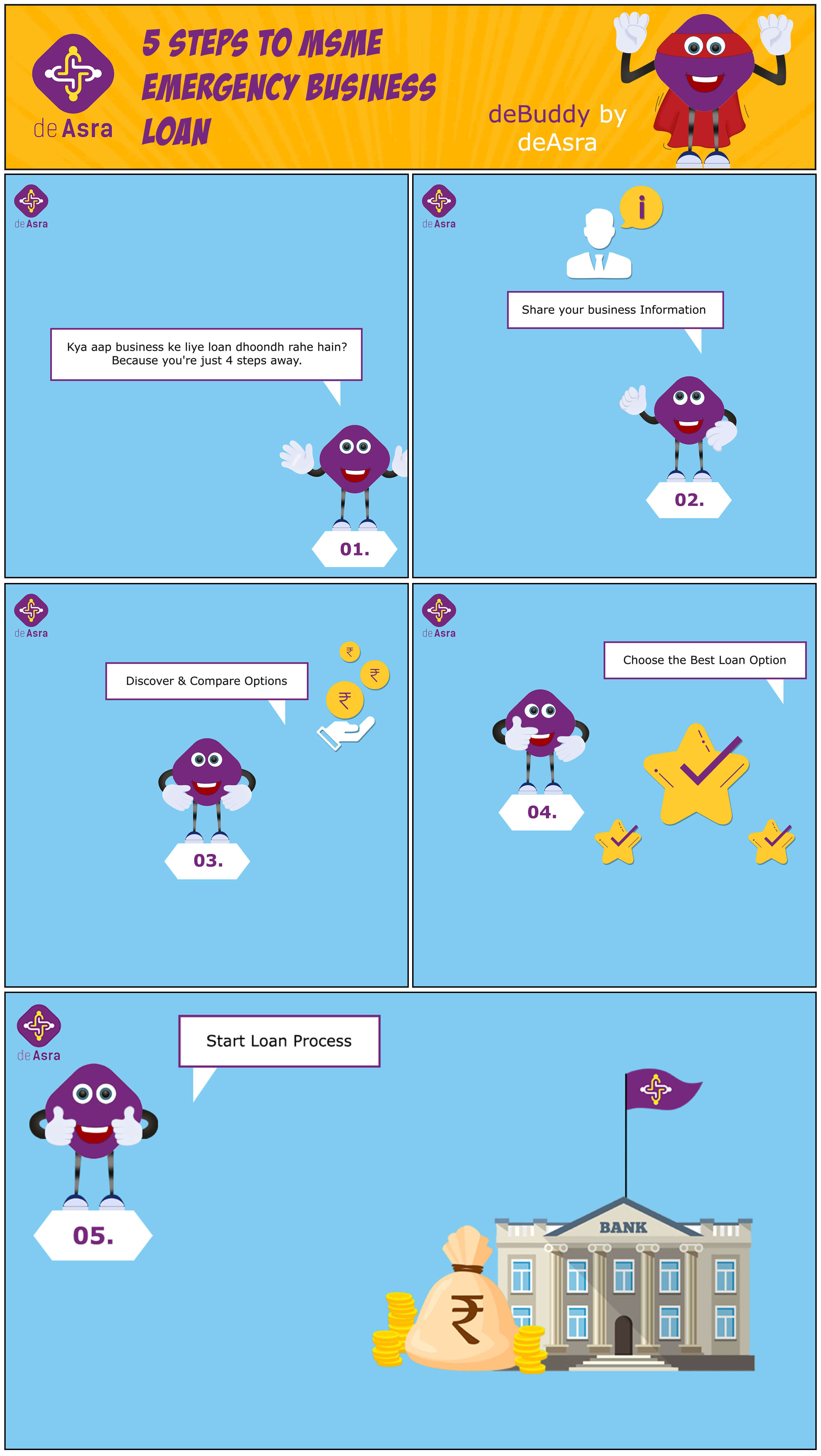

5 steps to MSME Emergency Business Loan

Looking to apply for an MSME business loan? Then you’re at the right place! deBuddy takes you through the steps of comparing your options and applying for the most suitable loan. Go ahead, get your MSME Loan with deAsra!

thanks for information