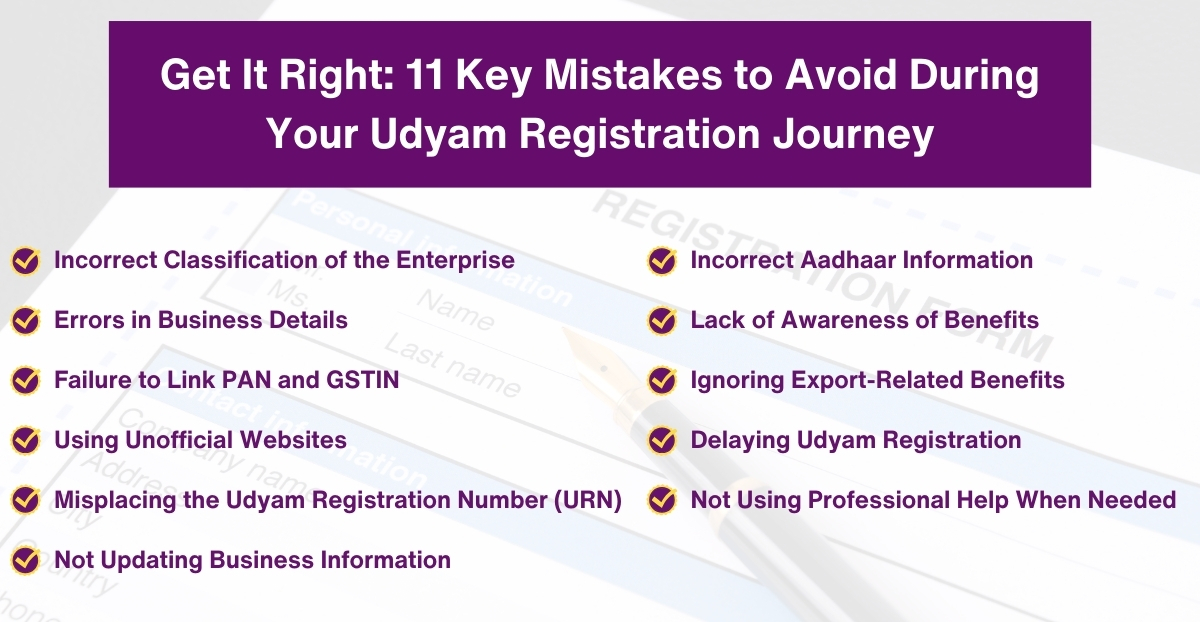

11 Common Mistakes to Avoid During Udyam Registration

Udyam registration is a vital step for small and medium-sized enterprises (SMEs) in India to gain access to numerous government benefits, including financial assistance, tax rebates, subsidies, and easier access to loans. Yet, many entrepreneurs make avoidable mistakes during the process, which can lead to delays, missed opportunities, or even rejection. In this blog, we will discuss the most common mistakes made during Udyam registration, offer practical advice to avoid these errors and ensure a seamless registration process for your business.

What is Udyam Registration?

Before we delve into the mistakes, let’s clarify what is Udyam registration. Launched by the Government of India, Udyam registration is a simple, paperless, online process aimed at classifying micro, small, and medium enterprises (MSMEs) to help them access government schemes, benefits, and financial support. Every business classified as an MSME must undergo this registration to get officially recognised. The system relies on key identifiers like the Aadhaar card and PAN and links GSTIN for eligible businesses.

Now that we’ve established what Udyam registration is, let’s dive into the most common mistakes entrepreneurs make and how to avoid them.

1. Incorrect Classification of the Enterprise

One of the most frequent mistakes is misclassifying the business. MSME Udyam registration requires enterprises to be classified as either micro, small, or medium based on their investment in plant and machinery or equipment, and their annual turnover. Misclassification can disqualify a business from various benefits or result in incorrect entries on the government records.

Avoidance Tip:

Ensure that your business is classified correctly according to the latest government guidelines:

- Micro enterprises: Investment up to ₹1 crore, turnover up to ₹5 crore.

- Small enterprises: Investment up to ₹10 crore, turnover up to ₹50 crore.

- Medium enterprises: Investment up to ₹50 crore, turnover up to ₹250 crore.

Misclassification could impact the support your business receives, including subsidies and access to certain financial assistance programs. Check your financials carefully, and if in doubt, consult an accountant or financial advisor to ensure you fall under the correct category.

2. Errors in Business Details

Accurate data entry is crucial during Udyam registration. Many entrepreneurs inadvertently submit incorrect business names, addresses, or owner details such as Aadhaar and PAN numbers. These discrepancies can lead to delays or even rejection of the application.

Avoidance Tip:

Double-check every detail you enter during registration. Ensure that the business name, PAN, Aadhaar, and other information match official records exactly. Even a minor spelling mistake or mismatch can cause your application to be rejected.

3. Failure to Link PAN and GSTIN

For small and medium enterprises (those with turnovers exceeding ₹40 lakh), linking the PAN and GSTIN (Goods and Services Tax Identification Number) is mandatory. Failure to link these identifiers correctly during MSME Udyam registration can result in the application being incomplete, or businesses may be disqualified from claiming certain benefits.

Avoidance Tip:

Before beginning the registration process, ensure that your PAN and GSTIN are linked properly. If you are a GST-registered business, this step is critical as it directly impacts your ability to claim tax benefits, access financial incentives, and participate in government tenders.

4. Using Unofficial Websites

Many entrepreneurs mistakenly register their businesses through unofficial websites that charge fees for services. The government’s official Udyam registration portal is free of charge, but third-party websites often mislead businesses, offering paid services that are unnecessary and unauthorised.

Avoidance Tip:

Always use the official Udyam registration website. Avoid third-party sites that may charge for what is otherwise a free process. The official portal provides step-by-step guidance and ensures that your business is properly registered without any hidden costs.

5. Misplacing the Udyam Registration Number (URN)

Once you complete the Udyam registration, you will be assigned a unique Udyam Registration Number (URN). Losing or misplacing this number can cause significant issues, especially when applying for government schemes or subsidies, or participating in tenders.

Avoidance Tip:

After receiving your Udyam Registration Number, keep it in a safe place. Maintain both physical and digital copies for future reference. This number is essential for tracking your MSME status and claiming benefits, so ensure it is easily accessible whenever needed.

6. Not Updating Business Information

Many entrepreneurs overlook the importance of keeping their Udyam registration details updated. Changes in the scale of operations, ownership, or turnover can affect the enterprise’s MSME classification, and businesses must update these changes to avoid being ineligible for benefits.

Avoidance Tip:

Regularly update your business’s details if there are changes in your investment, turnover, or ownership. Failure to do so could lead to missed opportunities, such as government grants or tax exemptions designed for MSMEs. The Udyam registration checklist can help you ensure you’re always up-to-date.

7. Incorrect Aadhaar Information

The Aadhaar number of the business owner, managing partner, or Karta (for Hindu Undivided Families) is mandatory during Udyam registration. Many entrepreneurs make the mistake of entering incorrect Aadhaar details, which can cause immediate rejection or delays in the application process.

Avoidance Tip:

Make sure that the Aadhaar number provided during the registration process is correct. The details on the Aadhaar card should match the details you provided during the registration, including the name, date of birth, and address.

8. Lack of Awareness of Benefits

Many businesses complete Udyam registration without understanding the full range of benefits they can access. Registered MSMEs are entitled to government schemes, subsidies, tax rebates, and access to specialised loans. Failing to explore these benefits means businesses may miss out on crucial support.

Avoidance Tip:

Take the time to explore the benefits and schemes available to MSMEs once you’ve completed the registration. These include credit facilities, lower interest rates, and a preference for government contracts. Additionally, you can leverage online marketing strategies to further boost your business’s visibility.

9. Ignoring Export-Related Benefits

For businesses that are involved in export, Udyam registration offers several advantages such as access to credit, subsidies, and participation in international trade fairs. Many businesses either don’t register for these benefits or are unaware of the opportunities available for MSME exporters.

Avoidance Tip:

If your business exports goods or services, make sure you take advantage of the benefits specific to exporters. These include lower-interest loans, financial aid for attending international trade fairs, and additional government support for export activities.

10. Delaying Udyam Registration

Some entrepreneurs believe that they can delay Udyam registration until they feel their business has grown enough to require it. This approach can lead to missed opportunities for early-stage financial support, tax exemptions, and other benefits that could help their business grow.

Avoidance Tip:

Register your business under Udyam registration as soon as you qualify as an MSME. This early registration gives you access to crucial support systems and government programs designed to help MSMEs thrive, even at the initial stages of your business.

11. Not Using Professional Help When Needed

While the Udyam registration process is straightforward, some businesses may need professional assistance, especially if they have complex ownership structures, large-scale investments, or unique registration requirements. Many entrepreneurs skip consulting professionals and end up making costly mistakes.

Avoidance Tip:

If you’re unsure about any aspect of the registration process, it’s a good idea to consult a legal advisor or an accountant who is familiar with MSME laws and regulations. This can save you from making errors that could impact your business’s eligibility for benefits.

Conclusion

Udyam registration is a vital process for MSMEs in India, providing a gateway to various government benefits and support schemes. However, as highlighted above, common mistakes such as incorrect business classification, errors in key business details, and misplacing the Udyam Registration Number can hinder the process. Entrepreneurs must be diligent, double-check their information, and regularly update their business details to ensure they remain eligible for MSME benefits.

By avoiding these common mistakes, you can streamline the Udyam registration process and ensure that your business enjoys the full range of advantages offered to MSMEs. Whether you’re a new or existing business, understanding what is Udyam registration and how to complete it correctly is the first step toward securing your business’s future success.

For a complete guide, check out this Udyam registration checklist to ensure that all steps of the process are covered, and consider these online marketing strategies to help your business grow post-registration.

FAQs

1. What is Udyam Registration?

Udyam registration is an online registration process for micro, small, and medium enterprises (MSMEs) introduced by the Government of India. It enables businesses to receive official recognition, allowing them to access various government schemes, subsidies, and financial assistance. The process is simple, paperless, and requires basic information such as the Aadhaar card, PAN, and, in some cases, GSTIN.

2. Is Udyam Registration mandatory for MSMEs?

While Udyam registration is not legally mandatory, it is highly recommended for all MSMEs in India. Registering provides access to numerous government benefits like financial assistance, tax exemptions, and priority in government tenders. Without it, MSMEs may miss out on the crucial support provided by government schemes.

3. What is the benefit of Udyam Registration?

Registering under Udyam registration allows MSMEs to take advantage of several benefits. These include subsidies on interest rates for loans, protection from delayed payments, eligibility for various government schemes, and easier access to credit. Additionally, MSMEs get preference in public procurement tenders, making it easier to secure government contracts.

4. Can I update my Udyam Registration details?

Yes, businesses can and should update their Udyam registration details if there are any changes in ownership, turnover, or investment in plant and machinery. Keeping your information updated ensures that your MSME classification remains accurate and that you continue to receive the benefits you are eligible for.

5. What happens if I make a mistake during Udyam Registration?

Errors during Udyam registration, such as incorrect business classification or data entry mistakes, can result in the rejection or delay of your application. It is essential to double-check all the information provided to avoid such issues. In case of a mistake, corrections can be made through the official Udyam registration portal.

DISCLAIMER:

This blog is provided by the deAsra Foundation (“deAsra”) for informational purposes only, offering insights that may be beneficial for micro, small, and medium-sized enterprises (MSMEs).

PLEASE NOTE: This blog is neither written nor endorsed by any governmental organization nor has any affiliation or connection with any government ministry in India. deAsra makes no warranty or representation regarding the information provided through this blog and disclaims its liabilities in respect thereof, including any liability for authenticity, errors, omissions, or inaccuracies in this blog, if any. Any action on the blog readers’ part based on the information provided in this blog is at his/her/its own risk and responsibility. deAsra reserves the right to modify the information contained in this blog at any time at its sole discretion. deAsra agrees that though all efforts have been made to ensure the veracity of the information in this blog, the same should not be construed as an accurate replacement for authorized commentary on the subject matter before it is used for any legal, financial, or business purposes. deAsra accepts no responsibility for the information’s accuracy, completeness, usefulness or otherwise. In no event will deAsra be liable for any loss, damage, liability, or expense incurred or suffered that is claimed to have resulted from the use or misuse of the information in this blog. We advise you to corroborate the information through authenticated sources and professional consultants before relying on the information stated in this blog. All the information in this blog is for educational and reference purposes only, and we do not make or charge any money to provide this information. Links to the relevant websites included in this blog are provided for readers’ convenience only. deAsra is not responsible for the contents or reliability of linked websites and does not necessarily endorse the views expressed therein. deAsra does not always guarantee the availability of such linked pages. If any content has been unintentionally published or copyrighted material in violation of the law, please don’t hesitate to contact us, and we will have it removed immediately.